Kom ihåg era närmaste och gör 2021 ett år värt att leva

KOLUMN I ÅBO UNDERRÄTTELSER

Timo Ketonen 12.01.2021 05:00

Jag vill inleda min första kolumn genom att visa tacksamhet för att få skriva till så många läsare av den lokaltidning jag gillat att läsa alltsedan min skoltid. Livet är lokalt är en alltjämt fungerande slogan – inte minst för en infödd Åbobo som nyligen fullföljt sin dröm om att flytta ut till skärgården.

Min dotter föddes i London 1992 och då bodde vi ’mitt i byn’ Chelsea i närheten av Knightsbridge. Då tänkte jag högt att om jag någon gång senare i livet har möjlighet till det vill jag bo ute i skärgården. På riktigt. Kustö var det första valet och sedan Harlax i Åbo. Men båda var förorter till en stad i Åboland.

När jag skriver denna kolumn denna söndagsmorgon ute på Snäckudden känner jag närheten till havet och naturen på ett helt annat, mycket mer personligt sätt. Jag kan väl säga att jag äntligen funnit lycka i mitt boende och ro i en rastlös själ.

En sak jag funderat djupt och ingående på under hela det gångna året 2020, i synnerhet efter flytten till ensligheten i skärgården, är hur vi människor tycker och tänker om varandra. Det har ju varit ett märkligt år, som vi alla vet och känner djupt inom oss.

Jag vill komma tillbaka till en text som jag skrev på allhelgonadagen, för att visa respekt för våra medmänniskor:

”Idag minns vi alla de som gått bort, våra nära och kära, samt givetvis alla de personer som finns med oss i dag, tacksam för deras kärlek och vänskap. Jag vill även ägna en tanke till de som gått vilse i sina liv. Ingen att förglömma. Jag är ödmjukt tacksam för att jag har så fina barn och så kära vänner.”

Många kanske tycker att sociala medier är ’so last season’, måhända har de rätt och det är ju ett val ni har i era egna händer. Det gjorde även jag när coronapandemin slog till i mars. Orkade inte läsa folks inlägg, varken negativa eller positiva. Orkade inte skriva nåt alls. Orkade inte längre med nyheter i traditionella medier, som handlade enbart om folks elände och ’världens undergång’ Kände en stark ångest – det var jobbigt i näringslivet, tufft för företagare och löntagare, kämpigt för oss alla.

Men det gäller att komma igen och att vara resilient: de tidigare generationerna har bemött långt värre svårigheter såsom världskrig och den svarta döden. I dag känns livet som nån typ av ’new normal’, det är många av oss som jag bemöter i vardagen som inte vill befatta sig med negativa nyheter eller negativa tankar längre.

Jag har mest känt mig positiv ända sedan hösten. Jag är frisk, känner mig relativt åldersbefriad, jobbar aktivt och har varit med om att grunda två nya företag i höstas (mer om detta i en senare kolumn) och är full av livslust. Det gäller att vända det negativa till något gott istället.

Detta kräver resiliens, det vill säga en förmåga att hantera förändringar. Vi alla kan göra det genom att visa empati och medkänsla; genom att motionera, äta hälsosamt och åtminstone försöka leva ett sunt liv. Nej, jag har inte blivit religiös. Men jag känner än stark tro på framtiden. Jag tror att vi alla ska ge livet en chans till.

Det tycker jag att vi gott kan göra inför detta nya år, låtom oss göra 2021 till ett mycket bättre år då vi får leva en normal, fast annorlunda vardag än den vi kände igen innan mars 2020.

En av mina favoritartister är Marie Fredriksson, som gick bort allt för tidigt i december 2019, endast 61 år gammal. Träffade henne med sin familj en gång i SAS loungen på Arlanda. Då var hon redan sjuk, men hade livsglädjen kvar. Hon hälsade vänligt och pratade en stund med mig. Jag sade att hennes musik betytt mycket för mig. Hon har skrivit så många fina sånger, men den som har titeln ”Tro” är kanske den finaste av alla.

Refrängen går:

Mera >Jag vill känna morgondagen nalkas här i lugn och ro i en vintervärld, finns det någon tro? /Jag vill känna önskan om en tid så ljus som friheten / Känna tro igen

It’s all about Impact

Ville Eromäki

This headline has been the key message at the business events I’ve participated in during the last two months. The Shift Business Festival and Sijoittaja 2019- fair were good examples of this.

The Shift Business Festival connected investors, entrepreneurs and other guests around the world at the beautiful Ruissalo shipyard in Turku during the last week of August. The weather rewarded the visitors with sunshine and a good atmosphere. Many visitors agreed it was the best Shift event to date.

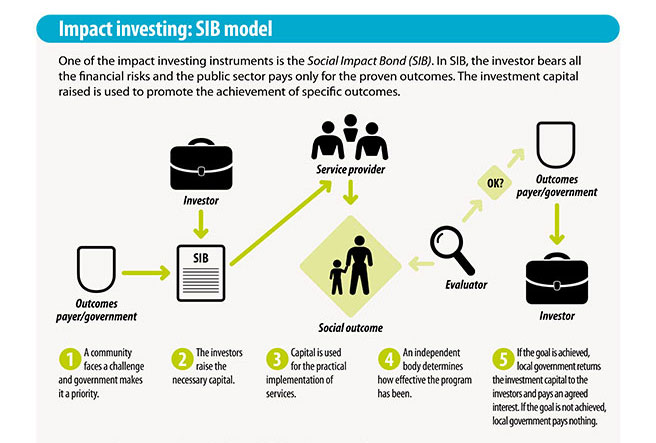

The festival started already on Thursday 28th Augusta with a side event Å Pitch where Mika Pyykkö from SITRA held an interesting speech about impact investing and how SITRA is making the impact through their SIB:s (Social Impact Bonds). But what do they mean with SIB, what is it about?

Social Impact Bond (SIB)

There are many instruments for impact investing and maybe the easiest to measure is the SIB model that SITRA uses. Even if the name reflects to a bond instrument, the SIB is really more like a fund instrument (contracts of different projects) that connects the money from SITRA, institutional and private investors with the service providers.

In the SIB model institutional and private investors invest in projects that promote well-being. The return on the investments depends on how well the projects succeed with the concrete, measurable positive impact targets that they are tied to. If the SIB-contract reaches its targets, investors receive the desired return and the society the pre-measured impact in a sense of wellbeing.

According to SITRA, each year, central government and local authorities in Finland make procurements valued at approximately 35 billion euros, so achieving an impact also implies more efficient use of billions of euros of tax revenue.

Taaleri as the frontrunner

Besides SITRA, maybe the most visible privately-owned firm with an impact message in the financial markets is Taaleri Plc. Also, as a main speaker at the Sijoittaja 2019 fair, Taaleri has been the frontrunner with impact investing since 2010 when their first wind energy fund was presented to the public.

Today Taaleri’s assets under management of wind and solar energy funds reaches a level of almost one billion euros and with these funds 1.2 million tons of carbon dioxide emissions have been saved from polluting the environment. The amount corresponds to the yearly emissions of almost 120,000 Finnish people. This, if some, is a pretty measurable positive impact! Besides the impact, Taaleri’s wind and solar energy funds have offered approximately 15 % return in average to the investors. Impact investing doesn’t have to be some charity investments as these numbers show. (Arvopaperi, 2019)

Thankfully also the other players in the financial market are wakening up. One good example is Osuuspankki that recently launched their Global Impact Fund where OP and Finnfund co-operate and promote the measurable well-being in accordance with the United Nations 17 sustainable goals.

It’s about ecological handprint, not just a footprint!

There are a lot of funds that boast a responsible investment strategy, but at least to my knowledge, usually these kinds of funds mainly exclude bad companies that are not suitable for responsible investments without really creating any new positive impact. It should be more about impact, not just investing responsibly.

To have a positive measurable impact is also the agenda we want to achieve with Aboa Advest. Since 2015, we, as a small Finnish family office, have wanted to transfer some measurable good into the society and environment, while aiming at a financial return over time. We take a rather long-term view with our investments in startups and growth companies.

It’s not too late for the others to join. In order to offer the life we have to our grandchildren and to be able to enjoy the weather we had at The Shift Business Festival, the world needs more significant investments with an impact from all the actors in the financial markets, not just from the small ones.

With impactful regards,

Ville Eromäki / Partner at Aboa Advest Oy

Mera >Home of the freest economy in the world

Mikael Ketonen

In early January I parted ways with a cold and slushy Helsinki scenery to embark upon a completely new experience in one of the most prominent and growing business metropolises in the world, namely Hong Kong. This is a city most well-known for its dense population, iconic neon lights and a skyline so filled with skyscrapers that only a handful of cities in the world can compete with. While the most obvious shock might have been the increase in population density from 16 people per square kilometre to nearly 7,000 people per square kilometre, Hong Kong is much more than just a densely populated city. It is the home of one of the strangest capitalist political systems in the world that markets itself as the freest economy in the world. It is a city that boasts the densest population of millionaires in areas such as Central and Admiralty, where every other piece of clothing you see reads either Balenciaga, Gucci or something of sorts. Meanwhile, just a 15-minute train ride away, areas like Sham Shui Po are cluttered with people selling fake electronics, clothing or collecting and selling cardboard off the streets just in order to make enough money to survive. It is a city that loves to display its luxurious lifestyle and money-centred culture while a large proportion of its citizens lie well below the poverty line. A division like this is by no means abnormal, but the reasons behind it make Hong Kong the most peculiar well-fare society in the world and raises enormous wonders regarding its future.

Symphony of Lights on Hong Kong Island, view from Kowloon

Sham Shui Po, Kowloon

Due to its complicated history, which includes an over 150-year period under British rule, the people of Hong Kong often have difficulties with recognizing their own identity and nationality. The British rule ended in 1997, with an oral agreement between the British and China which essentially entails that the current political system and the freedom of the people will remain unchanged for 50 years while Hong Kong adapts to the imminent reunion with China. In principle, the people are being forced to become Chinese, with whom they don’t even share a language, as the local Cantonese is very different from the Mandarin language spoken in mainland China. The opinions regarding this reunion are drastically split, as certain people see the threat of their personal and political freedom being reduced while others feel a stronger bond to mainland China. The consensus though, seems to be a general fear of the influence of the Chinese government and an unwillingness to identify as a Chinese citizen rather than a Hong Kong resident.

Wisdom Path near Big Buddha statue

Kowloon Peak

Economically speaking, the difference between the two nations is huge. Hong Kong boasts a system of minimal taxes, which makes it a paradise for corporate headquarters and wealthy individuals in general. To compensate for the revenue lost by minimal taxes, the government of Hong Kong has introduced a system where all the land belongs to the government. The land is then leased to real estate firms in an auction process, where prices usually surge to skyscraper-like heights. This lease is then incorporated into the price of an apartment or the rent, which explains why a one bedroom apartment in the city has an average rent of HK$ 18 000 (about 2050 €) a month. The obvious explanation for an inflated housing market like this is a lack of space, but in fact about 70 % of the land in Hong Kong is not being used and only 3,5 % of the land is zoned for housing. Thus, the prices are effectively deliberately being driven up, officially making Hong Kong the least affordable city in the world, by a landslide. According to The 15th Annual Demographia International Housing Affordability Survey (2019), the median property price is almost 21 times the median household income in Hong Kong. This means that most households can never even dream of owning an apartment in Hong Kong. Meanwhile, at one of the exclusive Golf Clubs on the Island side, the wealthy pay north of 35 million $HK for a membership. That is over 4 million €! It is an utterly strange setup, where a city has decided to go all out to ensure a free market and a fully-functional capitalist system, while simultaneously creating an impossible housing situation for the less wealthy. It is like the city has been designed to serve the rich in every way possible, but doesn’t know what to do with you if you are not.

Sheung Wan, Hong Kong Island

While the situation is indeed difficult and most of the blame is being shifted to the northern neighbour of Hong Kong, there is still a lot of hope and aspiration among the people. While the system is utterly divided, it still provides everyone with a chance to succeed, albeit facing enormous competition. When being accepted to one of the many universities in Hong Kong, students can live at university dorms for very reasonable prices, even on a Finnish scale. What needs to be emphasized is that the amount of money in Hong Kong is on another level compared to European cities and a common mind-set is that within this money lies the power to make improvements. ESG-factors (Environmental, Social & Governance) are becoming extremely important in corporations and among wealth managers in the city. While this will not solve the outrageous housing market, it still shows the willingness of the city and its residents to do their part and encourage sustainable investing and impactful behaviour in general.

Less wealthy individuals use the power of freedom of speech to constantly show their dissatisfaction towards the inefficient land management in Hong Kong. Other entrepreneurial minds are creating capsule-like homes of cheap materials to make the small apartments that people share more accommodating. While this is merely a band-aid type of solution, it shows that the people are effectively trying their best to find a solution to this one disastrous aspect of an otherwise exhilaratingly diverse and beautiful city. It is very difficult for a foreigner in the city to understand the very basis of this housing problem, as it is hidden away from the central areas and one really needs to search hard in order to see how scarce the availability of cheap living is in this self-proclaimed freest economy in the world.

Mera >