23.11.2023

23.11.2023

Timo Ketonen and Anette Ståhl donate 200 000 euros to The Sea – marine and maritime research at Åbo Akademi University

Press release by Stiftelsen för Åbo Akademi in Finnish and Swedish (Åbo Akademi University Foundation)

We are grateful for all contributions to our fund, received in connection with the Archipelago Sea Concert we arranged on 5th November at Logomo Teatro.

Anette Ståhl and Timo Ketonen

The annual grants will be dedicated to the top research profile The Sea at Åbo Akademi University and more specifically to researchers and students in “Environmental and Marine Biology”.

The Sea is a Living Lab for marine and maritime research with a focus on coastal and marginal seas. It was launched in 2017 as one of Åbo Akademi University’s key research profiling areas, with the support of the Academy of Finland. We work in collaboration with the University of Turku under the joint thematic profiling area “Sea and Maritime Studies”.

…

Archipelago Sea Concert graphics by Tero Lumiainen, Nitro.

Archipelago Sea Concert showreel and vido by Stian Vesterinen.

Photo by Studio Koo.

Press release by Freja Harkke, Å Communications.

More >FVCA: Startup funding in Finland drops from record highs in the first half of the year – Large funding rounds have slowed down, but early-stage investments are being made actively

FVCA press release

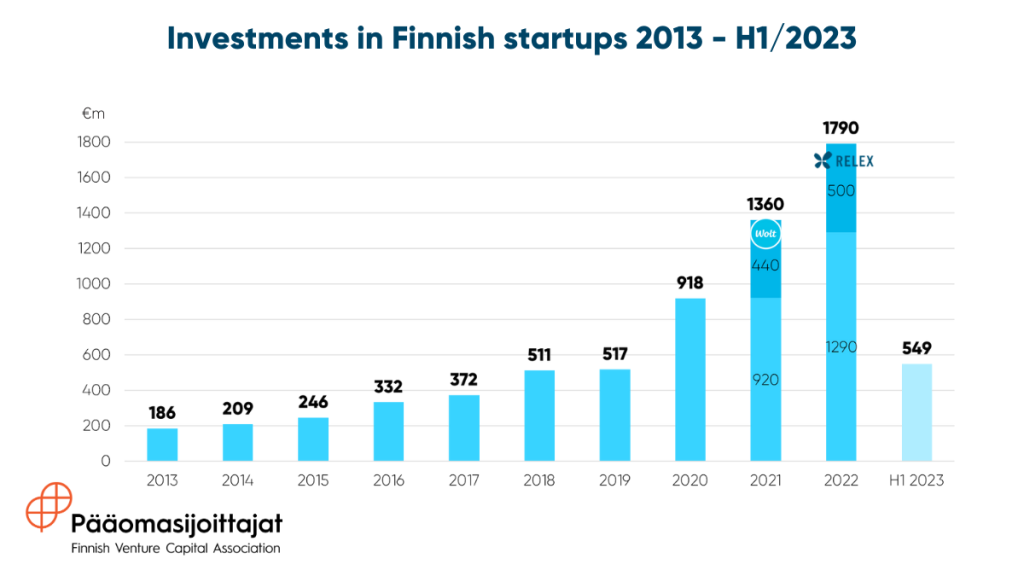

The amount of funding raised by Finnish startups in the first half of the year has decreased from the record numbers of previous years. Smaller investment rounds and the decrease in foreign investments explain the drop in the total funding amount. Finnish venture capital investors have achieved record fundraising, and investments in early-stage startups, in particular, are actively being made.

Finnish startups have raised a total of €549 million in growth capital during the first half of 2023, according to the latest statistics from the Finnish Venture Capital Association (FVCA). The share of venture capital and growth investments of the total sum is €217 million.

Based on the results from the year’s first half, the drop from peak years is significant. The Finnish startup ecosystem has experienced tremendous growth in recent years, with the amount of funding raised increasing year after year. In 2022, Finnish startups received an unprecedented €1.8 billion in investments, with venture capital and growth investments accounting for slightly over one billion euros.

“The slowdown in startup funding was observed in other parts of Europe and the United States in 2022, and considering the changed global situation, a decrease in investments was also anticipated in Finland. On a larger scale, this is undoubtedly partly a healthy correction in an overheated market,” comments Jussi Sainiemi, Deputy Managing Partner of the venture capital firm Voima Ventures and Chair of FVCA’s Venture Capital Committee.

In terms of the number of investments, Finnish startups have received investments in the first half of 2023 at a pace similar to previous years. The overall decrease in the total funding amount is mainly explained by the reduced activity of foreign investors and the absence of large investment rounds led by them, as well as a general decrease in the size of funding rounds.

“Of the fifteen largest startup investments in Finnish history, five, such as Relex‘s record-breaking €500 million, occurred in 2022. Hostaway raised a €162 million investment round in the first half of this year in a challenging market situation, but otherwise, large rounds have been absent this year,” remarks Jonne Kuittinen, Deputy Chief Executive of the FVCA.

“The role of Slush in attracting international investors to Finland is perhaps more crucial this year than ever,” he continues.

Record amounts raised by Finnish venture capital funds

The activity of Finnish investors in the first half of the year reflects the broader market situation: the number of investments has stayed relatively stable, but the invested amount has decreased from record levels. In total, 131 startups have received investments worth €124 million from Finnish venture capital and growth investors.

One record, however, has been broken this year: Finnish venture capital funds have raised €265 million in the first half of 2023, making it the best fundraising half-year in history. In the spring of 2023, Lifeline Ventures and Voima Ventures published their new funds.

“The successful fundraising of domestic investors is crucial for the Finnish startup ecosystem. The role of domestic investors is emphasised in challenging times when foreign investors are less active in the Finnish market,” Kuittinen points out.

Seed-stage investments made by Finnish investors have continued at a historically high level, so plenty of funding is still available for early-stage startups.

“A strong group of domestic VC investors ensures the availability of funding for the best companies even in uncertain times. Funding rounds may be more moderate, but portfolio companies are continuously supported, and new targets are constantly sought,” Kuittinen says and adds:

“We have not yet seen large rounds in the second half of the year, and there is a sense of anticipation in the market. The activity of Finnish VC investors in earlier-stage investments lays the groundwork for an increasing number of companies in Finland ready for larger follow-up funding rounds once again when the time is right.”

Read more about the H1/2023 statistics here.

Additional information

Jonne Kuittinen

FVCA, Deputy Chief Executive

jonne.kuittinen@fvca.fi

+358 44 333 3267

Jussi Sainiemi

Voima Ventures, Deputy Managing Partner

jussi.sainiemi@voimaventures.com

+358 40 564 4660

Juulia Korkiavaara

FVCA, Head of Communications

juulia.korkiavaara@fvca.fi

+358 40 673 8376

11.08.2023

11.08.2023

A’Pelago Initiative 10-11 August at Archipelago Centre Korpoström

The first A’Pelago Initiative event was a success: sharp thinking and well communicated by all. My warmest thanks and appreciation to all of you participants, keynote speakers, investors, business partners and our team

A BIG hand also to Turo Numminen and all the investor panelists and business case presenters on Day 2. Concrete initiatives well adapted for the Archipelago Sea theme. The Archipelago Centre Korpoström is an amazing place and everyone loved the local food and atmosphere.

Thank you Eva Johansson, Tuuli Toivola and your teams for your fine service. And last but not least – thank you Capt. Tuomo Meretniemi for your video greeting. Much appreciated by all and the word ‘appreciation’ means everything in team work. ”All business is people business’, as Piia Maaranen said.

The first day of A’Pelago Iniative was energized by our engaged participants and keynote speakers. The key challenges and opportunities of the Archipelago Sea Region were addressed and some of these are summarised below by A’Pelago team member Alina Sippolainen:

”To find silver bullets – not one but several – that benefit the archipelago ecosystem and create value, we need action in all fields of society.” Crystalizing statement to keep in mind from Christoffer Boström, Åbo Akademi.

A lot of Day 1 at the A’pelago Initiative has been about identifying where’s the value creation potential combining innovation, business and archipelago region insights. Let’s have a look at some key insights!

NATURE: ”Sea ecosystems provide us ecosystem services worth millions every day for free. At the same time, oxygen debt of the sea is massive and the sea in a heartbreaking state. A great part of the environmental value potential lies in minimizing the root causes for this.’’ Christoffer Boström

”VITAL ARCHIPELAGO of Finland is our road to the world. It is an interconnected system of nature, living, business and traffic. Business can benefit and enhance all these aspects. Balancing changes in the population level of the islands year-round is one important way to this.“ Kim Wikström.

SCIENCE-BASED TECH SOLUTIONS: ”Scientists need entrepreneurial skills and support from business to breathe alive future Game Changer business solutions. These solutions need to be branded as greatly as other world-leading brands”, Inka Mero

SUSTAINABLE INNOVATION FOR ARCHIPELAGO: “In the archipelago we have to think differently: we have few people and a lot of space. Innovations spark often when unexpected people are put into unexpected places. The liquid part of our Baltic Sea needs driven people“. Mårten Mickos

BRAND“Brand creation is of essence, we need to make people understand the value of Finland in order to market our unique qualities. Often I have to start by telling people about the Nordics”, Clarisse Berggårdh about ”Helsinki Happiness”; the last quote is my interpretation of her talk.